Auctions & Cross-Border Capacity

How transmission capacity is allocated between European bidding zones through explicit and implicit auctions.

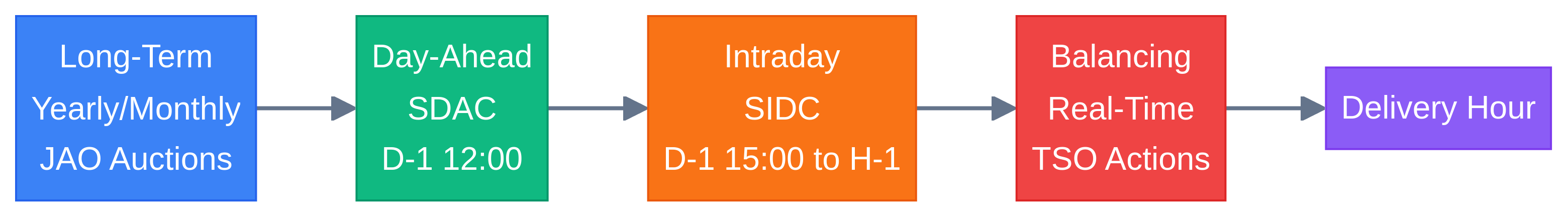

Long-Term (Explicit)

Yearly and monthly auctions conducted by JAO. Traders buy Physical or Financial Transmission Rights (PTR/FTR) to secure capacity in advance.

Day-Ahead & Intraday (Implicit)

Capacity is allocated automatically as part of energy trading through SDAC and SIDC. No separate capacity auction needed.

Cross-border auctions allocate the limited transmission capacity available on interconnectors between European bidding zones. Without coordination, traders in different countries might schedule conflicting power flows that exceed physical line limits, causing grid instability.

Two Allocation Methods:

Explicit Auctions

Capacity is sold separately from energy. Traders buy transmission rights (PTR/FTR) in advance, then nominate (use) them or resell them. Used for long-term contracts.

Implicit Auctions

Capacity is allocated automatically as part of energy market clearing (SDAC/SIDC). EUPHEMIA algorithm optimizes both energy and transmission simultaneously.

TSOs (Transmission System Operators)

Calculate available capacity based on grid state, weather forecasts, and outages. Provide capacity data to JAO and NEMOs. Examples: RTE (France), TenneT (Netherlands/Germany), National Grid (UK).

JAO (Joint Allocation Office)

The single platform for long-term explicit auctions in Europe. Conducts yearly, monthly, and daily auctions for cross-border capacity on behalf of 28 TSOs across 28 borders.

NEMOs (Nominated Electricity Market Operators)

Power exchanges that run implicit auctions (SDAC/SIDC). Use EUPHEMIA algorithm to allocate capacity as part of energy market clearing. Examples: EPEX SPOT, Nord Pool, GME.

Market Participants (Traders, BRPs)

Buy transmission rights to hedge price differences or enable cross-border arbitrage. Balance Responsible Parties (BRPs) use capacity to optimize their portfolios across zones.